Corporate Property Sale Complete Guide and Insights

Corporate property sale refers to the process of selling properties owned by companies or organizations, often including office buildings, industrial facilities, retail centers, or land intended for business use. Unlike individual property sales, these transactions are complex, high-value, and usually involve multiple stakeholders such as corporate boards, investors, and legal teams.

The sale of corporate property is often tied to larger business strategies. For example, companies may sell real estate assets to free up capital, restructure operations, or reinvest in core activities. Because of the stakes involved, these sales require detailed planning, valuation, and negotiations that go far beyond standard real estate transactions.

Why Companies Choose to Sell Corporate Property

There are several reasons why a company may decide to sell its property assets. One common motivation is financial optimization. A corporate property sale can unlock significant amounts of capital that can then be redirected into business growth, technology upgrades, or debt repayment.

Another reason involves strategic shifts. For instance, a corporation might downsize office spaces in favor of hybrid work models or move operations closer to major transportation hubs. Selling unused or underutilized properties allows businesses to adapt quickly to changing market dynamics without holding on to costly assets.

Key Considerations in Corporate Property Sales

When managing corporate property sales, companies must carefully evaluate several key aspects. One of the most important is property valuation. Determining the correct value requires in-depth analysis of market conditions, comparable sales, and the property’s potential income.

Legal compliance is another critical factor. Companies must ensure the sale adheres to zoning laws, contractual obligations, and tax regulations. Additionally, corporate boards often require detailed reports before approving property sales, making transparency and thorough documentation essential.

How Technology Supports Corporate Property Sales

Technology plays a transformative role in simplifying the complex process of corporate property sales. Digital property management platforms allow companies to centralize documents, track progress, and share information securely with stakeholders. These platforms reduce delays and errors that often occur with manual handling.

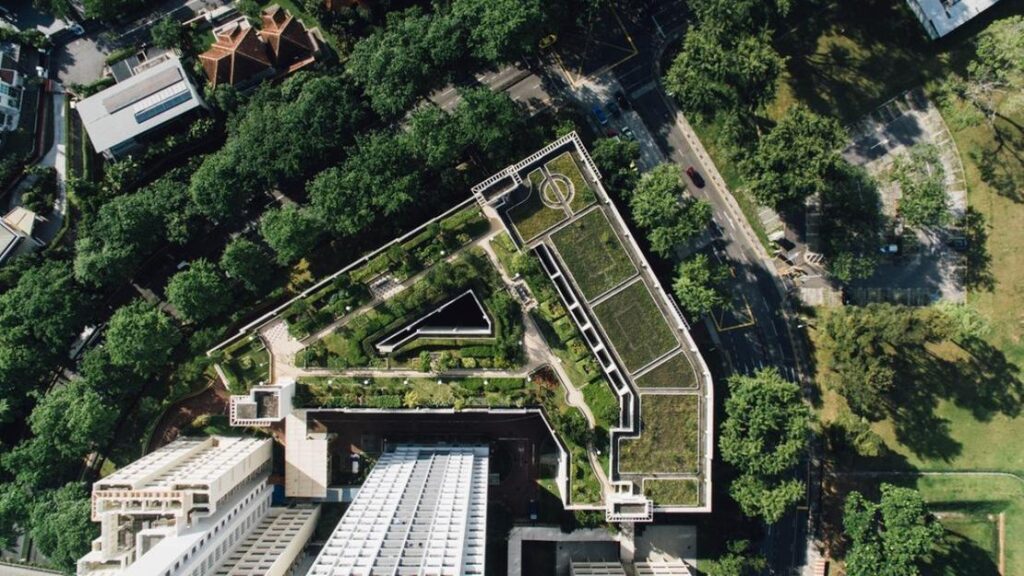

Advanced analytics and AI-driven tools are also valuable. They provide predictive insights into market trends, helping companies decide the best time to sell. Virtual reality tours, drone photography, and 3D mapping give potential buyers an immersive view of properties without physical visits, expanding the reach of marketing efforts. By integrating technology, corporate property sales become faster, more transparent, and more efficient.

Real-World Examples of Corporate Property Sales

Example 1: Office Tower Disposition

A multinational corporation decided to sell its downtown office tower after shifting to hybrid work. The property had high maintenance costs and was underutilized. By working with real estate advisors, the company sold the asset for a strong market price, reinvesting proceeds into digital infrastructure.

Example 2: Retail Center Divestment

A national retail chain sold a large suburban shopping center to focus on e-commerce operations. The corporate property sale freed up capital and reduced overhead, while the buyer repositioned the property as a mixed-use development. This case highlighted how property sales can align with evolving business models.

Example 3: Industrial Property for Logistics Expansion

A manufacturing company sold unused warehouses near major highways. A logistics provider acquired the facilities, repurposing them for distribution hubs. The corporate seller reduced maintenance costs, while the buyer gained valuable locations for expanding delivery efficiency.

Example 4: Corporate Land Sale

A financial institution sold a large land parcel originally purchased for expansion, but left unused. The land was bought by developers who built commercial complexes. This transaction showcased how selling non-core assets can eliminate wasted resources.

Benefits of Corporate Property Sale for Businesses

Selling corporate property offers multiple advantages. The most direct is financial liquidity. Capital tied up in real estate can be redeployed into core business activities that drive growth and innovation. This flexibility allows businesses to stay competitive in fast-changing industries.

Another benefit is operational efficiency. Maintaining unused or oversized properties can drain resources. By selling them, corporations cut ongoing costs like maintenance, taxes, and utilities. Additionally, sales can reduce debt levels, strengthen balance sheets, and improve investor confidence. These outcomes make corporate property sales a strategic tool for business transformation.

Use Cases: How Corporate Property Sales Solve Business Challenges

1. Supporting Business Transformation

When companies pivot toward new industries or adopt digital models, they often sell traditional office or retail properties. This helps them fund their transformation without excessive borrowing.

2. Managing Financial Pressures

Organizations facing financial challenges use property sales to raise immediate capital. This capital can support restructuring, acquisitions, or operational stability.

3. Optimizing Real Estate Portfolios

Large corporations with diverse property portfolios may periodically review and sell assets that no longer align with business needs. This ensures resources are concentrated on high-performing assets.

4. Adapting to Remote and Hybrid Work

As more businesses embrace flexible work environments, demand for large corporate offices decreases. Selling or downsizing office space allows companies to adapt to modern workforce trends.

5. Facilitating Mergers and Acquisitions

In M&A scenarios, overlapping properties are often sold to streamline operations. Corporate property sales in this context help reduce redundancies and generate funds for integration efforts.

Strategic Approach to Corporate Property Sales

A successful corporate property sale requires a strategic approach. First, companies must align property sales with long-term business goals rather than focusing solely on short-term financial gain. This ensures decisions support the overall corporate direction.

Second, engaging professional advisors, including real estate brokers, financial analysts, and legal experts, adds value. Their combined expertise helps companies maximize returns while avoiding compliance risks. Finally, timing is critical. Market conditions, interest rates, and economic outlook should all be considered before finalizing sales to achieve the best possible outcome.

Frequently Asked Questions

1. What is the difference between a corporate property sale and a standard property sale?

A corporate property sale involves business-owned assets, which are larger in scale, value, and complexity compared to standard residential or small property sales.

2. How does technology improve corporate property sales?

Technology enhances efficiency through digital platforms, analytics, and virtual marketing tools. It streamlines communication, speeds up transactions, and widens the buyer pool.

3. Why do companies often sell corporate properties during restructuring?

Selling properties provides quick access to capital, reduces overhead, and helps companies focus on core operations during periods of organizational change.