Flipping Land for Profit Complete Guide to Successful Land Investing Strategies

Flipping land for profit refers to the practice of buying raw or underdeveloped land at a lower price and then selling it at a higher price after making improvements, rezoning, or simply holding it until market demand increases. Unlike traditional house flipping, land flipping doesn’t involve physical structures but instead leverages market trends, location demand, and development potential.

This type of real estate investment has gained popularity in recent years because land, unlike houses, requires no maintenance costs such as repairs, insurance, or utilities. Investors can hold onto it with relatively low overhead until the right buyer comes along. However, success requires research, patience, and the ability to identify opportunities before they become obvious to others.

Why Flipping Land Can Be Profitable

The profitability of flipping land lies in its scalability and flexibility. Land can be acquired in rural, suburban, or urban areas, and investors can target different niches such as agricultural, recreational, or residential development opportunities.

Another key factor is appreciation. As communities expand and populations grow, land values tend to rise naturally. This makes flipping land an accessible strategy for both new and experienced investors, offering significant profit potential without the complications of property management.

Key Strategies for Flipping Land Successfully

Researching Market Demand

The first step in flipping land is understanding the market. Investors need to research growth trends, infrastructure development, zoning laws, and population migration patterns. Areas near upcoming highways, schools, or commercial centers often experience sharp increases in land value.

Market research not only reduces risks but also identifies hidden opportunities where prices are still low but are projected to rise in the near future.

Adding Value Through Rezoning or Improvements

Sometimes raw land has limited use due to zoning restrictions. Rezoning land for residential, commercial, or mixed-use purposes can dramatically increase its value. Similarly, minor improvements such as clearing the land, adding fencing, or even securing utility connections can make the property more attractive to buyers.

The strategy is to buy low, enhance the land’s potential, and then sell at a premium.

Timing the Market

Just like stock investments, timing is everything in land flipping. Investors often hold onto land for months or years until demand spikes. By analyzing market cycles, interest rates, and local development plans, one can maximize returns by selling at the peak of demand.

Benefits of Using Technology in Land Flipping

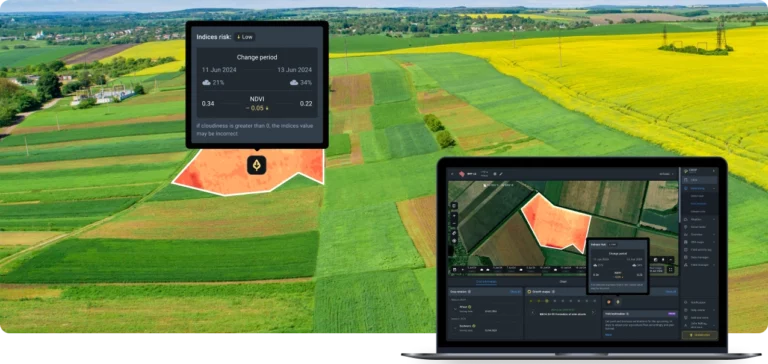

Technology has revolutionized the way investors approach land flipping. Geographic Information Systems (GIS), satellite imaging, and online property databases make it easier to analyze potential investments.

Digital platforms also help in evaluating land values, checking zoning information, and even running drone surveys. With advanced mapping tools, investors can assess topography, soil quality, flood risks, and access to utilities, which all influence a property’s value.

Additionally, marketing land has become more efficient. Online real estate platforms, social media, and virtual tours allow sellers to reach potential buyers far beyond their local market, increasing visibility and selling speed.

Real-World Examples of Flipping Land for Profit

Example 1: Agricultural Land Near a Growing Suburb

An investor purchased farmland near a suburban area at a low price. Within five years, the city expanded toward the property, rezoning it for residential development. The investor sold the land at triple the purchase price. This illustrates how identifying growth corridors can turn raw land into a goldmine.

Example 2: Recreational Land for Outdoor Activities

A piece of rural land with scenic views and water access was purchased cheaply. The investor made minimal improvements, such as adding trails and signage, before marketing it to outdoor enthusiasts. The land was quickly sold at a significant markup, showing how niche markets like recreation can drive profits.

Example 3: Vacant Urban Lots

An investor acquired several vacant lots in a mid-sized city that were zoned for residential use. With urban redevelopment initiatives on the horizon, these lots became highly desirable for developers. By holding onto the lots until redevelopment plans were approved, the investor doubled the investment in under two years.

Example 4: Timberland Investment

A parcel of land covered in mature trees was bought with future resale in mind. The investor worked with forestry experts to calculate timber value, then marketed the land to companies interested in sustainable logging. The combination of timber value and resale appeal allowed for a strong profit margin.

Example 5: Desert Land Near Renewable Energy Projects

An investor purchased inexpensive desert land near proposed solar farm projects. As renewable energy companies sought suitable locations, demand for such land increased. The investor was able to sell quickly to an energy developer at a much higher price, showing how emerging industries can influence land value.

Practical Benefits of Flipping Land

The practical benefits of flipping land include low holding costs, minimal management requirements, and significant appreciation potential. Unlike houses, land doesn’t deteriorate, making it a “hands-off” investment.

Flipping land also offers flexibility. Investors can work with small rural plots or larger parcels, depending on budget and goals. The scalability makes it accessible for beginners while still appealing to seasoned professionals.

In addition, land flipping often comes with fewer legal complications compared to developed properties. With no tenants or structural repairs to worry about, the focus remains on location, zoning, and future demand.

Real-Life Use Cases of Flipping Land

Solving Urban Expansion Needs

As cities expand, developers need land to build housing, schools, and businesses. Land flippers who anticipate these needs can provide the necessary parcels, making a profit while supporting urban growth.

Providing Affordable Entry for Investors

Land flipping is often less capital-intensive than buying houses or commercial buildings. This makes it an excellent entry point for new investors looking to break into real estate with lower risk.

Supporting Niche Markets

Whether it’s recreational land for camping or farmland for organic agriculture, land flippers help connect specific buyers with properties suited to their goals. These niche markets can be highly profitable when properly targeted.

Unlocking Hidden Value in Underutilized Land

Many parcels of land remain overlooked due to zoning restrictions or a lack of infrastructure. Skilled land flippers see beyond these limitations and create opportunities that others might miss, turning neglected land into valuable assets.

Frequently Asked Questions

1. Is flipping land more profitable than flipping houses?

Flipping land can be just as profitable as flipping houses, but it depends on location, market timing, and strategy. While houses may provide quicker returns due to higher demand, land carries lower risks and costs, making it a long-term wealth-building tool.

2. How long does it take to flip land for profit?

The timeline varies widely. Some flips can happen within months if demand is high, while others may take years as investors wait for market conditions to improve. Success depends on research, patience, and timing.

3. What are the main risks of flipping land?

Risks include zoning restrictions, lack of infrastructure, environmental concerns, and market downturns. Investors can mitigate these risks through careful research, due diligence, and diversification of land types and locations.